If you're preparing to buy a home, you've likely encountered more than one checklist for buying. House hunting is only the beginning of the process, and it's important not forget any crucial steps along the way.

While homebuyer checklists can seem long and overwhelming, there are a few key points to focus on. Here are three things to pay special attention to when making your own checklist for buying a house:

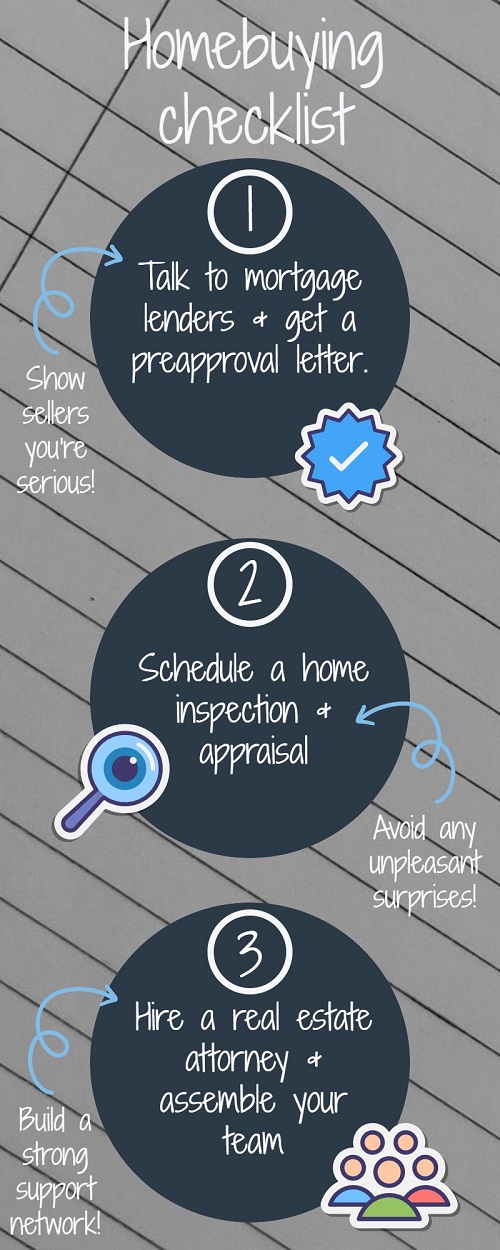

The first important step in finding your next home is speaking with a mortgage company. The lender will do a thorough investigation of your financial profile, including metrics like debt to income ratio (DTI) and your credit report. If you meet the criteria for approval, you'll get a preapproval letter from the lender.

However, it is important to remember that approval letters will not necessarily mean a commitment to any lender. You still have the option to shop around to find the best mortgage lender for your situation.

The next stage is scheduling professional visits to the home to determine a fair purchase price. Home inspectors will make sure the structure of the home is up to code. Your inspector will test your electrical and plumbing system and will send you the detailed reports.

There may be additional charges or separate inspections required to detect presence of radon or mold during inspection. While home inspections are not always required, they are highly recommended, as they can help prevent hidden issues which can affect your home values in the future.

A real estate lawyer is another excellent professional to have on your team. The homebuying process includes complicated legal forms and jargon, which an attorney can help you understand and give you advice. They can assist you throughout the process and go over any official documents such as contracts of sale and title documents for any missing info.

For an even smoother process, many experts recommend shopping for a mortgage broker and clearing up any issues with credit scores long before you begin house hunting. However, once you find your dream home, these key tips will help you have a successful buying experience.

Trusted Advisor, Friend, and Neighbor

With 20 years’ experience in real estate and mortgage lending, along with deep roots in Franklin County, Cathy is the real estate expert with both local knowledge and a global network at her finger tips. Cathy connects with her clients, actively and respectfully listening to what their needs are, and delivers results for them, time and again.

Cathy understands the complexity of the lending side of real estate transactions, and brings in-depth knowledge to both buyers and sellers. Cathy is also the recipient of the coveted 10 Best Real Estate Agent for Client Satisfaction two years in a row in Massachusetts.

Cathy covers Franklin and Hampshire counties in the Pioneer Valley of western Massachusetts. Whether you're in the research phase at the beginning of your real estate search or you know exactly what you're looking for, you'll benefit from having a real estate professional by your side. Cathy would be honored to put her real estate experience to work for you.